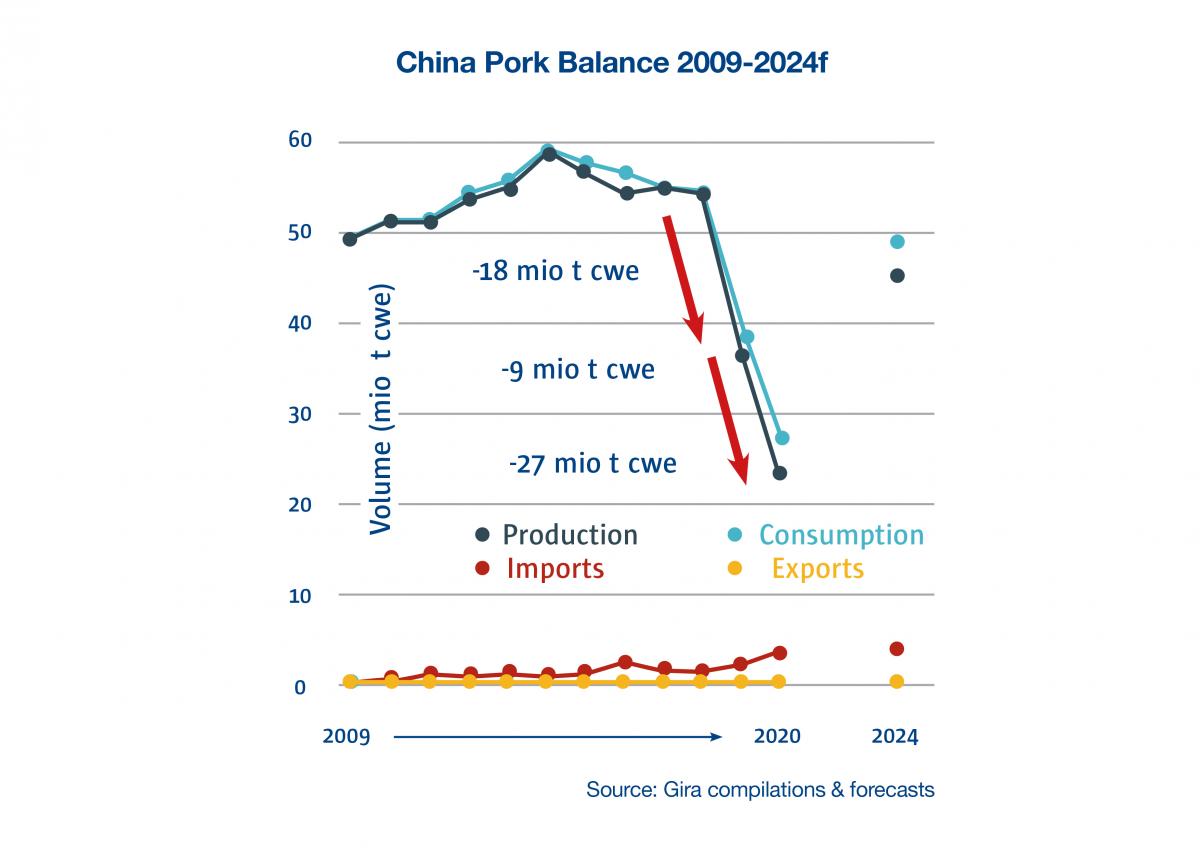

In view of the importance of Asia, and more particularly China, a change in that region has a global impact on the pork sector. The current outbreak of African swine fever has consequences for the global pork industry and even has repercussions on the other types of meat.

The global pig herd was already experiencing a downward trend. Above all, thanks to the food safety and environmental-driven restructurings in China, but African swine fever further strengthened this trend despite the growth of the herd in most of the other regions. In 2019, production already fell sharply and this will continue in 2020 due to the amount of time that China will need to rebuild its pig herd. Consumption will follow production and will fall, but it will rise again in the medium term. In turn, trade will rise sharply in view of the shortages in Asia. Only the supply limits trade.

Production

From 2000 to 2018, global pork production experienced linear growth thanks to a larger and more productive herd which resulted in heavier carcasses over the years. After the catastrophic impact of African swine fever on production in 2019 and 2020, it is expected to recover by 2024. Recovery in China was anticipated for the end of 2020 but as a result of the coronavirus, it will probably be by the beginning of 2021, and even a little later in the other Asian countries.

In the medium term, European production will fall in view of the societal pressure on pig farming, but production will increase in Russia and America. Productivity will increase everywhere with more efficient pig farming and more vertical integration. Backyard farming will disappear in Asia.

Trade

In view of the situation in China and the rest of Asia, the trade in pork will nothing but increase in 2020. Asia will represent two thirds of total imports in 2020 with China as the most important destination. In the rest of the world, however, trade is stabilising due to the limited offer and strong prices. Exports to Canada and the United States are falling because both countries have increasing production and the need for imports is disappearing. Protectionism is bearing fruit in Russia. Imports are not rising and Russia is even well on its way to becoming a small exporter.

The export of pork is in the hands of four main players: Europe, Canada, the USA and Brazil. All exporting countries focus on the most lucrative markets which results in shortages on the own domestic markets and at times even on other export markets.

Consumption

Worldwide the consumption of pork is evolving in a positive way, except in Europe where demand will fall further. The days of cheap pork as a result of low feed costs in Europe are over. The Asian prices are ‘depriving’ Europe of pork. As a result, prices are also rising in Europe. In addition, the anti-meat discussion is gaining ground in Europe so there is even more pressure on consumption.

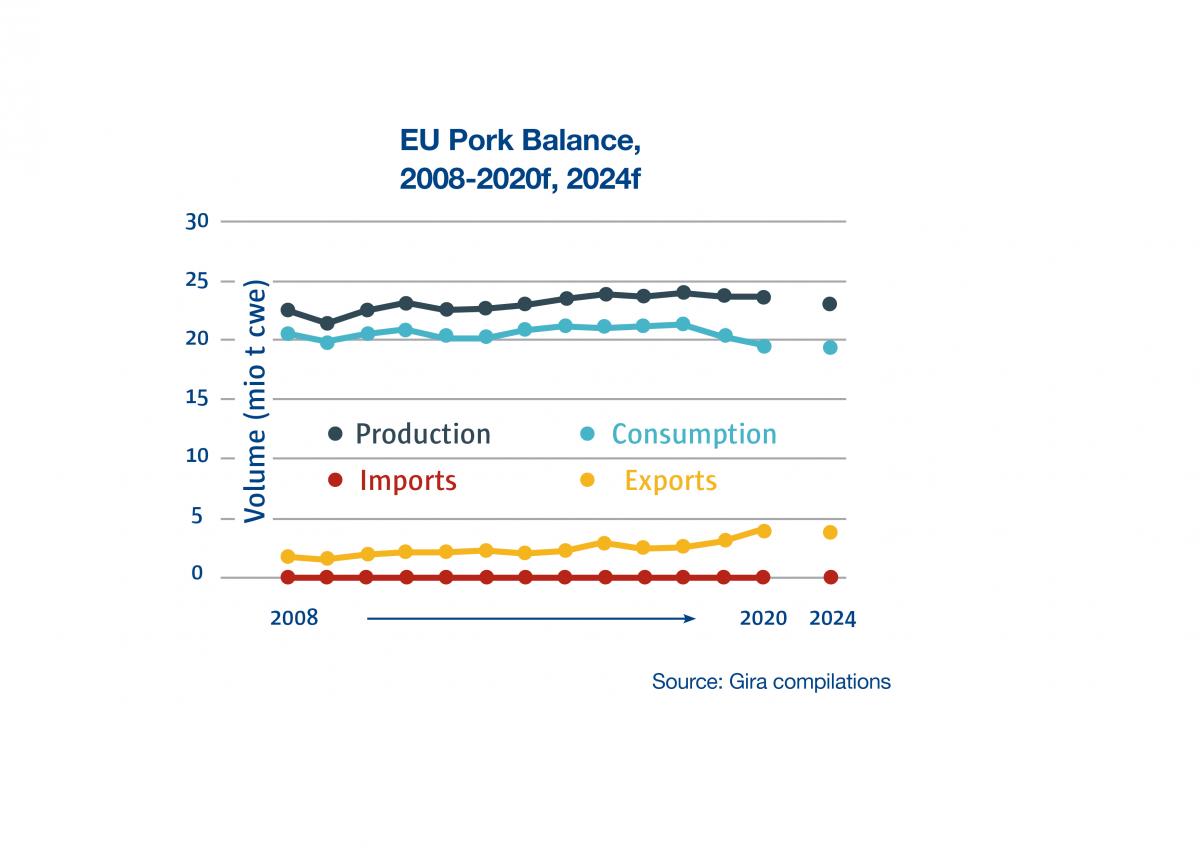

Europe

In the last few years, European production stabilised at around 24 million tonnes. The good profitability in 2016 and 2017 led to increasing production in 2018 but gradually the market came under pressure. The downward trend in the sow herd is partly compensated by the increased productivity but consumption will go down in the long term.

In 2019, production fell by just under one percent. France and Spain experienced an increase in production, whilst in the Netherlands, Germany, Belgium and Poland production fell. The large stock was quickly eliminated at the beginning of 2019 due to the increased demand from China. Falling availability of pork on the European market is partly responsible for the falling consumption in Europe.

Under the influence of sustainable demand from the export markets, stable production is expected for 2020. Prices will also be sustainable and probably even rise. Despite these good prospects, there is little room for a rise in production. Space is only available in Spain and some regions of France. In Eastern Europe, African swine fever is a problem and in the north (Denmark, Netherlands, Germany and Belgium), there is pressure from society (animal welfare and the environment) and a demographic problem (no successors and a lack of workers). Normally, Chinese demand will continue in 2020 which offers good perspectives for the pork market.

In the longer term, (2024) a fall in production in line with the fall in consumption is a likely outcome. Major producers will maintain their production level and the older producers will stop without there being any successors.

United States

Growth is the keyword in American pork production. The sow herd has grown by 1% and the number of pigs also rose by 3%. The number of animals slaughtered also went up with 4%. Imports fell by 10% and exports rose by 6%. Consumption also follows the positive trend, rising by 2.5%. However, the trade wars with both Mexico and China were also an important issue that was resolved in the course of 2019. In addition, the additional capacity of the packers gradually became available during the year. Production was far higher than expected thanks to the productivity of the sow herd causing the price increases to be disappointing.

The sow herd looks set to grow even further in 2020, as will production. Exports will rise by another 25% thanks to the high demand in China and prices will recover thanks to the African swine fever. In the longer term, the United States will become a more important player in the global export of pork.

China

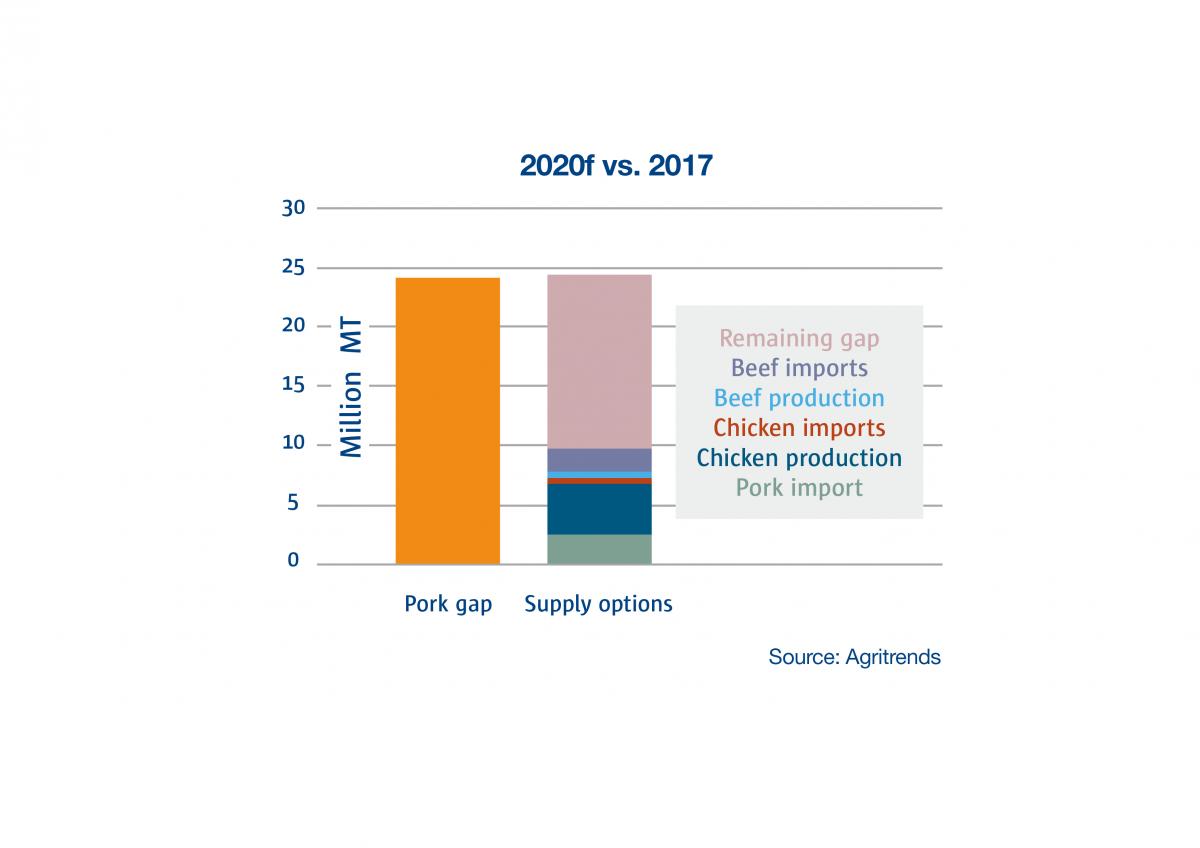

In 2017, 62% of the meat consumed in China was pork. That amounted to 54 million tonnes of meat. In 2020, there is a shortage of around 24 million tonnes or almost half of the consumption. The herd has been reduced by over half to just under 200 million pigs. This means all hands on deck to find the necessary proteins for China.

Import

In the last few years, China’s import volumes have been rather volatile. After the sharp rise of 2016, 2017 and 2018 were rather disappointing, whilst there was once again high demand in 2019 (+60% compared to 2018) to close the gap caused by the African swine fever crisis. In 2020, import volumes will continue to rise so that China alone will represent 40% of the global trade in pork. An increasing number of companies are being approved for direct access to China and the grey channel via Hong Kong is fading. Europe remains the main supplier, but the USA and Canada also continue to be important exporters despite the tariffs and the Huawei incident respectively. Brazil, finally, completes the list. Import is also shifting to larger cuts and half carcasses.

Chinese demand for imports will remain high until the end of 2024 but will not continue indefinitely. The Chinese government sees the rebuilding of the pig herd as a priority and will provide the necessary resources.

At the moment, however, no one is succeeding in overcoming the shortage that has arisen in China. The shortage as a result of the outbreak of African swine fever and the accompanying decrease in the pig herd in China is estimated at 24 million tonnes for 2020. The import of pork is expected to rise further. And that of poultry and beef will also increase, but to a lesser degree. The production of poultry and beef will also increase, but a gap of 15 million tonnes still remains that is not being addressed. This will lead to a change in the consumption pattern with a loss of 10 to 15% in the meat basket for pork.