GIRA is an international consultancy and market research firm with expertise in meat, dairy, bakery and fish markets and production. Rupert Claxton, Meat Director at GIRA, was a guest at Belgian Meat Office’s Round table event where he spoke about COVID-19 and its effects on the meat industry.

ASF disrupted the global meat industry and was almost immediately followed by COVID-19, which shook up the world. The meat industry has been hit a second time in a short period of time. COVID-19 has had and will continue to have a global impact on consumption, production, and export in the second half of 2020 and into 2021. Despite these challenges, the meat industry has shown signs of recovery. Even so, the future and the full impact of COVID-19 remains uncertain.

COVID-19 and its global impact

COVID-19 and its impact on the meat industry have been looked at from the very beginning.

In the first phase, the initial lock down in China, food services were shut down. People panicked and stuffed their fridges and freezers with lots of products, including meat. This caused a massive surge in retail buying. This panic buying phenomenon not only occurred in China but in nearly every market with a COVID-19 outbreak. As product gets stripped off the shelves, the supply chain gets into trouble. It can’t keep up. Shortages make the national news, which leads to even more panic buying as people are scared products, such as meat, would become scarce or unavailable.

As people were getting used to lockdown, panic buying subsided and eventually stopped. The supply chain then had a chance to catch up, which it did. When the number of cases stabilized, the country began to ease and food service improved. The problems, however, were not over. Some factories were open but others were either short on laborers or had to shut down due to too many COVID-19 cases in the work force. This issue has been seen in the meat industry in many other markets as well.

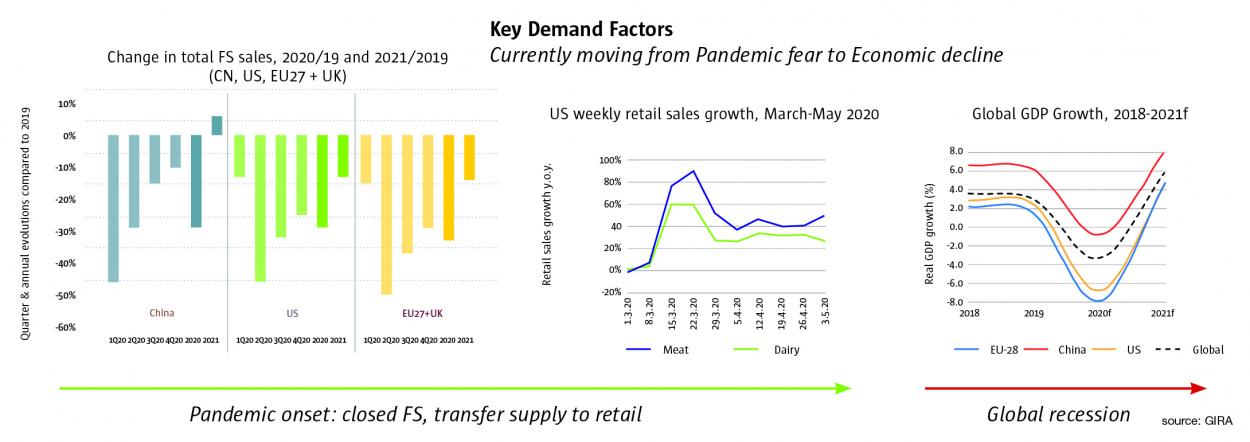

The next challenge for the meat industry will be to deal with the economic impact COVID-19 will undoubtedly have. It’s hard to predict what the future will bring but during and after the financial crisis of 2008 consumers started downtrading (from beefsteak to mince, beef to chicken, …) This will most likely will happen again in the second half of 2020 and in 2021, which means less demand around the world and different ways of servicing it. The backdrop that has just been explained works not only in China but in nearly every market with a COVID-19 outbreak.

The impact on the meat industry

It’s important to know the impact COVID-19 has (had) on food services, and retail as well. For China, the biggest loss came in Q1 around the time of Chinese New Year. The graph at the top of page 3 shows a 44% loss in food service, which is a massive hit. As for the US and Europe, that loss happened in Q2 with 42% and 52% respectively.

2020 as a whole is down in every market but, according to GIRA, China is expected to be back up in 2021, just above 2019 levels. The food services in Europe and the US are expected to be down in 2021. Part of the reason is that people have moved their buying to retail, which is good recovery for the loss in food service. However, it’s important to note that not all volume has been moved over to retail, so there is a reduced market due to the pandemic. As for the global financial crash: the top markets are expected to recover but they will not be back to 2019 economic levels.

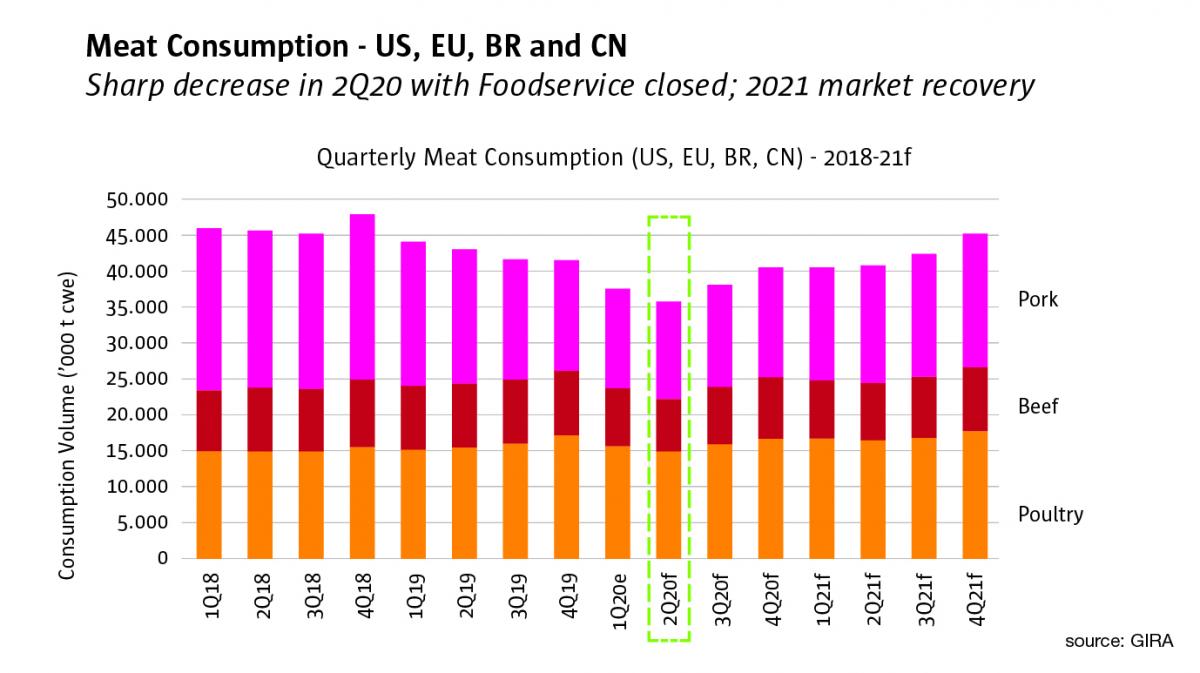

Meat consumption

In 2019, there was a decline in meat consumption (see graph at the top of page 3), which is most notable in pork (compared to e.g. chicken, which went up). The reason pork consumption declined was ASF in China. It dropped again in Q1 of 2020 as the Chinese struggled with demand, to get the animals to slaughter, and to move product within the country. In the second quarter, Europe and the U.S. were also being affected by COVID-19. After a period of hoarding, the demand dropped and consumption declined even further. As food services reopen and people adjust to the new normal, the demand goes back up but not to pre-corona levels.

The EU COVID-19 challenge

The first thing to note is that the economic impact in Europe is worse than in the rest of the world. This is partly because Europe has a very developed economy and maintained strict measures, but also partly because Europe’s COVID-19 has been particularly severe due to the dense population and a lot of international travel which made it easy for COVID-19 to spread.

European meat demand

For most meats, the lowest demand came in Q2. Going into Q3, plant closures are disrupting the meat supply and are changing price points. Simultaneously, people are starting to have doubts about job security, are faced with reduced salaries or job loss. As a result, domestic demand drops, which leads to more export, specifically to China as that market recovers.

Production and export to China

Production follows a similar pattern: a sharp decline in Q2 as food services and some slaughter houses close and a slow recovery in Q3. Europe is expected to continue to recover going into 2021 but will have to export more since European demand will be weaker.

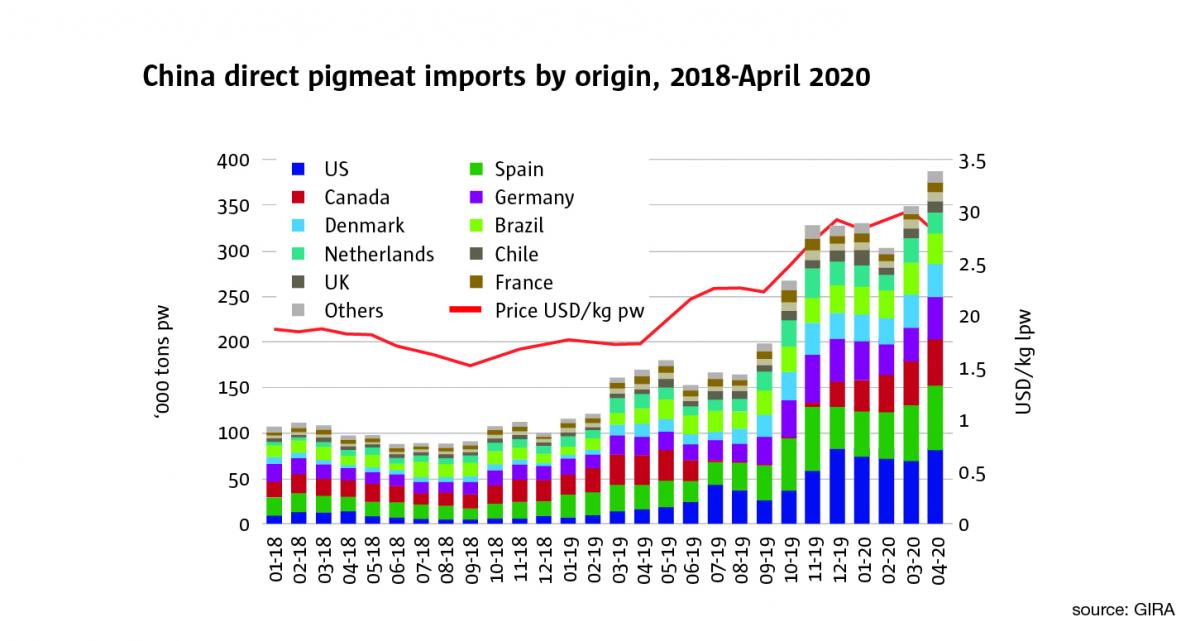

Pork specifically will struggle in Europe going forward. Since there is a widening gap between production and consumption, the opportunity to grow and add value by exporting more of the pig at higher value will be important.

Export to China is key. Back in 2018, the EU-countries had (combined) 100.000 tonnes of pork a month going to China (see graph on the right). Mid-2020, around 300.000 tons are exported each month. That is a huge step-up, driven by ASF and at higher prices. There was a dip early on in the coronavirus crisis because of the uncertainty of China’s buying but Chinese prices have remained positive. And even though European prices have fallen, they are still above the level of pre-ASF in China. To sum up: China is still very short of pork and very much open to buying.

It’s safe to say that both ASF and COVID-19 have destabilized the world (of the meat industry) and that the impact of this double hit - but especially COVID-19 - is far from over. The world will continue to face immediate as well as long term economic problems. Even though the markets are slowly recovering and are expected to continue to recover, 2021 will be a difficult year of rebalancing and uncertainty.