The growing global demand is being offset by rising production and last year resulted in increased trade figures for every kind of meat. The export share of global production rose last year for beef, sheep and goat, remained stable for pork and fell slightly for poultry.

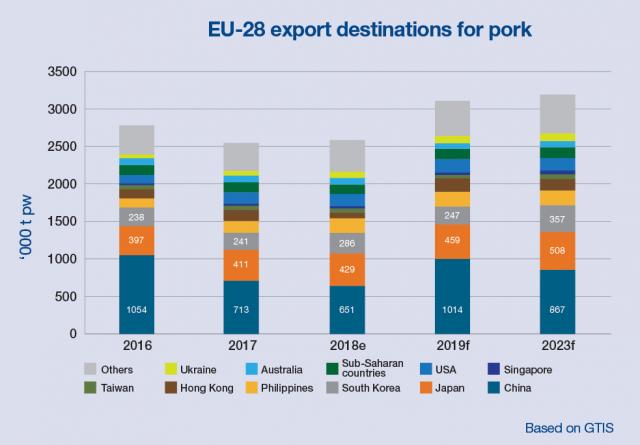

A world without trade disputes was inconceivable in 2018 and above all the USA and Brazil were affected. It’s not unlikely that Europe can profit from the trade war between the USA and China for the export of pork. The growing role of Asian countries in global imports means that there is haste to enter into a free-trade agreement in Asia.

What brings 2019?

An increase in trade is once again expected for 2019. The African swine fever will above all lead to a sharp increase for the trade in pork. Or is it still too early? There are still quite a few uncertainties linked to the Chinese demand for the next few years. The shortage as a result of the outbreaks of ASF will not last for ever and will accelerate China’s agro-industrialisation.

Beef

World

The beef sector continues to develop, albeit with price erosion of the recent peak levels. During the past few decades, the cattle population has grown constantly. This expansion cycle is now slowing down in the USA and Argentina and is coming to a complete standstill in Canada. In Brazil, the liquidation phase is slowing down and in Australia the drought is once again having an impact.

Transposed to production, it still means a lot of slaughterings due to the high prices for cattle, even if they are falling. Consumption has also risen due to the large supply and the good import demand from Asia is cushioning the increased export supply.

Europe

In Europe, the sustained demand is leading to better prices. Production rose by just under 2%, triggered by the reduction of the suckler herd and the summer drought. This led to fodder shortages and an increase in the number of slaughterings.

In trade, there is no change in the import quotas and export continues to grow after a short fall in 2018. The European import of beef has risen for the first time after years of falling. The impact of CETA is starting to become visible and the volumes from Brazil and Argentina are also increasing after having remained at a low level for years.

Consumption of beef in Europe rose by 2.5%, partly as a result of better economic conditions in Europe and the rise in available income.

Pork

World

Impossible to consider the pork sector without China as a player. The global pig population fell

slightly following restructuring in China, that started due to food-safety and environmental issues. The outbreaks of African swine fever in China will further accelerate and strengthen the process towards industrialisation. In the other producing countries, however, the pig population is expected to grow.

The global production of pork is expected to rise in the medium term due to improved productivity and restructuring. In the short term, production will first fall as a result of the mortality rate and slaughterings due to ASF in China. Consumption will follow production and in the medium term grow after supply constraints in 2019.

The sharp demand in Asia in 2018 is continuing in 2019 with an even higher demand. However, it is impossible to assess when the expected shortages will result in higher demand from China.

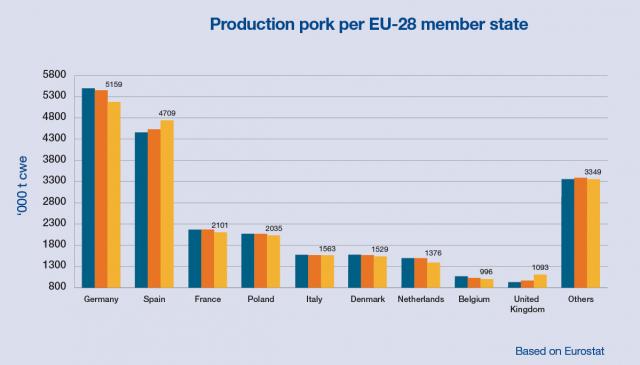

Europe

A production peak for pork is expected in 2019. In Eastern Europe, it is difficult to maintain the

production level due to the outbreaks of African swine fever. In Western Europe, greater demand is expected from China and other export markets. On the other hand, environmental issues and new consumer habits are also leading to falling consumption.

The European pig population will continue to grow in 2019, despite the expected reduction in the number of sows in the next few years. Every year, the productivity of sows is still increasing, which guarantees continuity of the productivity gains. In the medium term, the population may reduce slightly, leading to a minor decrease in production.

The expected Chinese demand and the demand from other markets outside the EU will push up the price of European pork in 2019. This on the assumption that there will not be any outbreaks of ASF amongst the major European players. The export markets remain the key to keeping the pork prices and producers economically viable.