Meat continues to occupy an important place in the Belgian diet. Home consumption of fresh red meat decreased in 2019 (-3% in kg per capita). This home consumption accounts for three quarters of the total consumption of red meat. The other quarter is consumed outside the home.

The majority of Belgians regularly alternate red meat with poultry, fish and vegetarian options. The share of poultry (mainly chicken) and vegetarian meat substitutes is increasing, although the share of the latter remains very limited (1.1% in volume). Belgians thus continue to enjoy some meat regularly and consciously because of the taste, their eating habits and the nutritional value of meat.

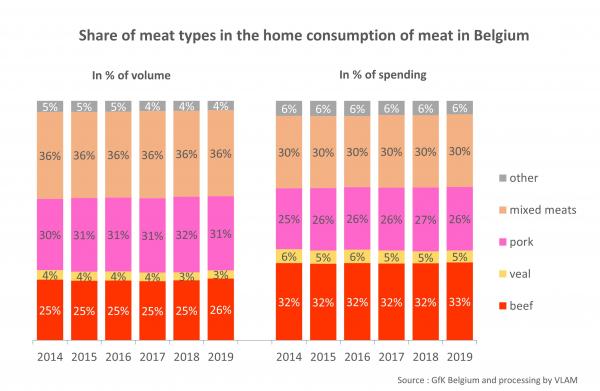

The range of meat purchased has remained fairly stable over the years. The mixed meats are the largest segment in volume. Beef is the highest in value.

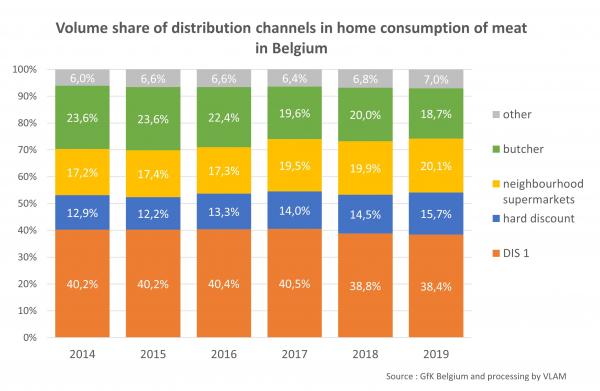

As regards the purchasing channels, the local supermarket and hard discounters (Aldi and Lidl) gained market share. The source of meat has become more important as a purchasing criterion, and domestic meat is preferred by 96% of Belgians who attach importance to the source.

All these data are the result of research commissioned by VLAM and carried out by GfK Belgium and iVox.

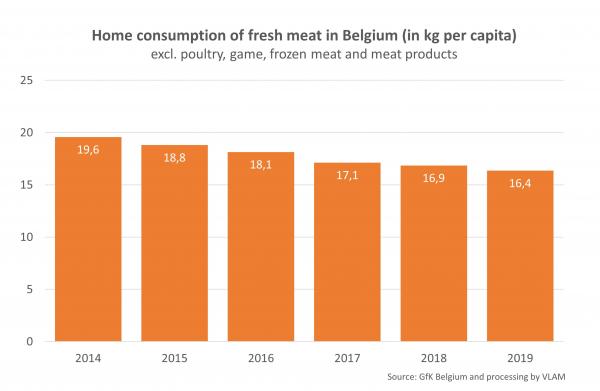

The average Belgian bought 16.4 kg of fresh red meat in 2019

On behalf of VLAM, GfK Belgium keeps track of the purchases for home consumption of 5,000 Belgian households, which constitute a representative sample of the Belgian population. This shows that almost all Belgian households (97%) sometimes buy red meat (pork, beef, veal, lamb, mutton and horse meat) for consumption at home. This percentage has remained virtually unchanged in recent years.

However, the purchase frequency of an average family decreased from 43 times per year in 2014 to 38 times in 2019. This is partly due to the decreasing number of shopping trips by Belgians: we shop less often but buy more per shopping trip (one-stop-shopping). We also see a slight increase in the volume of red meat per purchase, but not enough to compensate for the decreasing number of purchasing moments. As a result, home consumption of fresh red meat decreased from 19.6 kg per capita in 2014 to 16.4 kg per capita in 2019.

Red meat retains an important place in eating habits, but Belgians vary their diets

The decrease in the home consumption of fresh red meat is partly due to the fact that we have again been eating outside the home more in recent years (see below), and because we are more frequently alternating red meat with poultry, fish or vegetarian alternatives. In addition to the home consumption of 16.4 kg of fresh red meat, the average Belgian bought 8.4 kg of fresh poultry and game last year, 4.6 kg of fresh fish, molluscs and crustaceans and 0.35 kg of vegetarian meat substitutes. In the long term, the proportion of poultry, especially chicken meat, within this product basket is growing, as is the proportion of meat substitutes. The proportion of the latter remains limited to 1.1%.

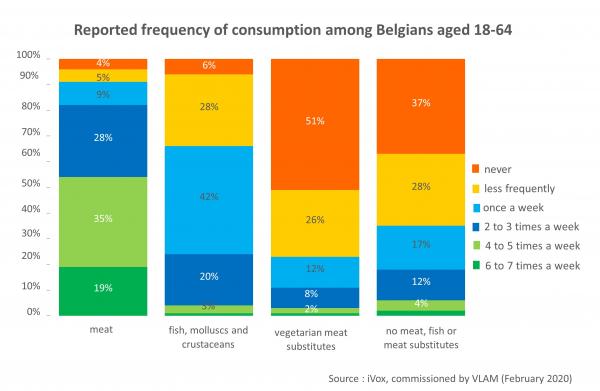

Of respondents, 72% say they eat meat one to five times a week, 19% eat meat more often and 9% eat meat less often or never. Fish, molluscs and crustaceans are on the menu once a week for 42% of Belgians. Some 23% of Belgians eat a vegetarian meat substitute at least weekly, and 35% eat a meal without meat, fish or a typical vegetarian meat substitute at least weekly. However, these last percentages are increasing.

Taste, habit and nutritional value are the main drivers for meat consumption

Meat continues to occupy an important place on the Belgian plate. According to the iVox study, the main reasons why Belgians regularly eat meat are:

- The taste: Belgians like meat and thus want to eat it regularly. (79% like the taste of meat)

- Meat is very much part of our Belgian food culture: we were raised eating meat and continue to do so in our later eating habits. If there is no meat on their plates, Belgians get the feeling that the balance on their plates is lost and the meal is not complete.

(81% think that meat is part of our Belgian food culture) - Because, according to the Belgian, meat is nutritious, provides strength and has a satiating effect.

(72% recognise that meat contains important nutrients that we need, such as proteins, vitamins and minerals) - Meat is easy and more familiar to buy and prepare.

- Within the range of meat available, you can vary endlessly so that you can eat it almost every day without feeling like your diet is monotonous.

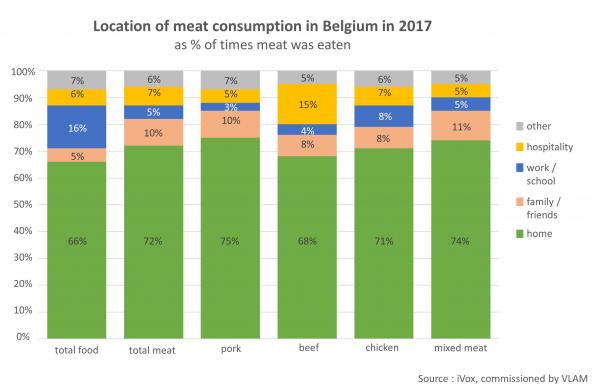

Home is the place of consumption par excellence

Home is and remains the main place where food is consumed, and 66% of the time that we consume something is at home. As a result of the financial and economic crisis that occurred in 2008, people started eating at home or with family or friends even more, which increased this percentage in the following years. In recent years, eating outside the home has been on the rise again, and we are once again reaching pre-crisis levels. Unfortunately, the outlook for this level of eating outside the home is particularly bleak, owing to the coronavirus crisis in 2020.

Meat has an even more pronounced home profile than food in general. For the total category of meat and poultry, 72% of consumption takes place at home. The second most significant place of consumption is with family and friends, representing 10% of the times meat is eaten. The hospitality industry follows at 7%, and next is work/school at 5%. Events, reception halls, etc. account for the remaining 6%. However, the types of meat eaten differ from one type of location to another. Beef, for example, is eaten relatively more often in hotels and restaurants and poultry is eaten more often at work/school. On the other hand, pork and mixed meats are more likely to be consumed at home.

Limited shift in the range of meat

We saw few shifts within the range of fresh red meat in 2019. The mixed meats (including mixed minced meat) remained the largest segment with 36% of the volume, followed by pure pork with 31%. The volume share of pure beef increased from 25% to 26% in 2019 and is the largest meat segment in value terms (33%). Veal is a small segment (3% in volume and 5% in value).

Source becoming increasingly important in meat purchasing choice

The appearance of the product remains the most important aspect in the purchase of meat, together with the expiry date. Then come the price, the type of cut, the type of shop and the packaging. Only then follow aspects such as source and production method.

However, the importance of the country of origin increased from 52% who considered this important in 2013 to 61% in 2020, and the importance of the production method rose from 42% to 50%. For those who attach importance to the country of origin, 96% have a preference for domestic products. They prefer domestic meat because this is often cheaper, because it supports the local economy, because there are strict controls and high standards, because it is more environmentally friendly (including fewer food miles), because it is fresher, etc. The perception of Belgian meat is developing positively. More than half of people think the price of meat is acceptable or they have no opinion.

Hard discounters and neighbourhood supermarkets are growing

DIS 1 (hypermarkets and larger supermarkets such as Albert Heijn, Carrefour Hypermarkets, Carrefour Market, Colruyt, Delhaize Supermarkets, Makro, etc.), remain the most important players with a volume share of 38.4%. They did lose market share in 2019, mainly in favour of hard discounters (Aldi and Lidl). Neighbourhood supermarkets also continued to grow and they are the second most important channel after DIS 1 and hold one fifth of the red meat market. The butchers could not hold their 2018 profits and lost ground again. Here, some 18.7% of the volume and 22.6% of the spending on red meat is at the butcher’s counter.